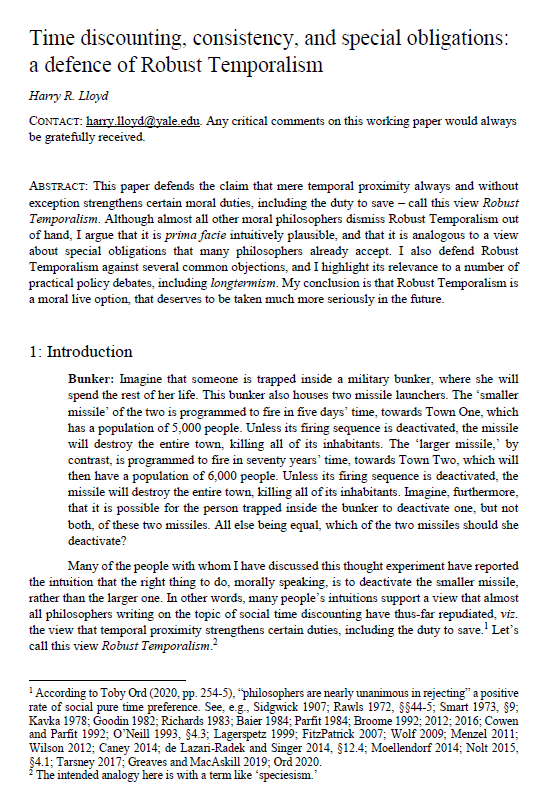

Time discounting, consistency and special obligations: a defence of Robust Temporalism

Harry R. Lloyd (Yale University)

GPI Working Paper No. 11-2021

This is the winning entry of the Essay Prize for global priorities research 2021. The uploaded paper is the full, revised draft of the abridged paper submitted for the prize competition.

This paper defends the claim that mere temporal proximity always and without exception strengthens certain moral duties, including the duty to save – call this view Robust Temporalism. Although almost all other moral philosophers dismiss Robust Temporalism out of hand, I argue that it is prima facie intuitively plausible, and that it is analogous to a view about special obligations that many philosophers already accept. I also defend Robust Temporalism against several common objections, and I highlight its relevance to a number of practical policy debates, including longtermism. My conclusion is that Robust Temporalism is a moral live option, that deserves to be taken much more seriously in the future.

Other working papers

Three mistakes in the moral mathematics of existential risk – David Thorstad (Global Priorities Institute, University of Oxford)

Longtermists have recently argued that it is overwhelmingly important to do what we can to mitigate existential risks to humanity. I consider three mistakes that are often made in calculating the value of existential risk mitigation: focusing on cumulative risk rather than period risk; ignoring background risk; and neglecting population dynamics. I show how correcting these mistakes pushes the value of existential risk mitigation substantially below leading estimates, potentially low enough to…

Existential risk and growth – Leopold Aschenbrenner (Columbia University)

Human activity can create or mitigate risks of catastrophes, such as nuclear war, climate change, pandemics, or artificial intelligence run amok. These could even imperil the survival of human civilization. What is the relationship between economic growth and such existential risks? In a model of directed technical change, with moderate parameters, existential risk follows a Kuznets-style inverted U-shape. …

Can an evidentialist be risk-averse? – Hayden Wilkinson (Global Priorities Institute, University of Oxford)

Two key questions of normative decision theory are: 1) whether the probabilities relevant to decision theory are evidential or causal; and 2) whether agents should be risk-neutral, and so maximise the expected value of the outcome, or instead risk-averse (or otherwise sensitive to risk). These questions are typically thought to be independent – that our answer to one bears little on our answer to the other. …